Introduction: Protecting Wealth Before Growing It

In professional investing, success isn’t only measured by returns — it’s measured by how well capital is protected when markets turn volatile. Hedging is the strategic art of risk offset — taking one position to counterbalance another, reducing exposure to market shocks.

On a Global trading platform, hedging has evolved into a dynamic, accessible discipline. What was once the domain of institutional investors is now available to professionals and private traders alike, enabling precision control across asset classes like equities, FX, commodities, indices, and digital assets.

Hedging doesn’t eliminate risk — it manages it intelligently, ensuring portfolios survive downturns long enough to benefit from the next upturn.

What Is Hedging?

Hedging involves entering financial positions that offset potential losses from other investments. The aim isn’t to maximize returns but to minimize volatility and preserve capital.

Common hedging instruments include:

- Options: Buying put options on stocks or indices helps protect against downward moves.

- Futures Contracts: Used to lock in prices for commodities, indices, or currencies — ideal for businesses or funds managing future obligations.

- Currency Forwards: Crucial for international portfolios, protecting against foreign exchange swings.

- CFDs (Contracts for Difference): Enable investors to hedge exposures without owning the underlying asset directly.

These tools allow investors to tailor hedging strategies based on their risk appetite, portfolio structure, and time horizon.

Why Hedging Matters

In volatile global markets, hedging isn’t optional — it’s fundamental. It plays a central role in ensuring consistent performance and confidence among investors.

Key benefits include:

- Volatility Control: Smooths out portfolio fluctuations during unpredictable periods.

- Predictable Returns: Offers stability in cash flows, particularly for pension funds and endowments.

- Capital Preservation: Protects against catastrophic losses that could take years to recover.

- Confidence and Continuity: Enables long-term planning and strategic growth without fear of short-term disruption.

Professional investors view hedging as an insurance policy — an expense that safeguards the portfolio’s long-term health.

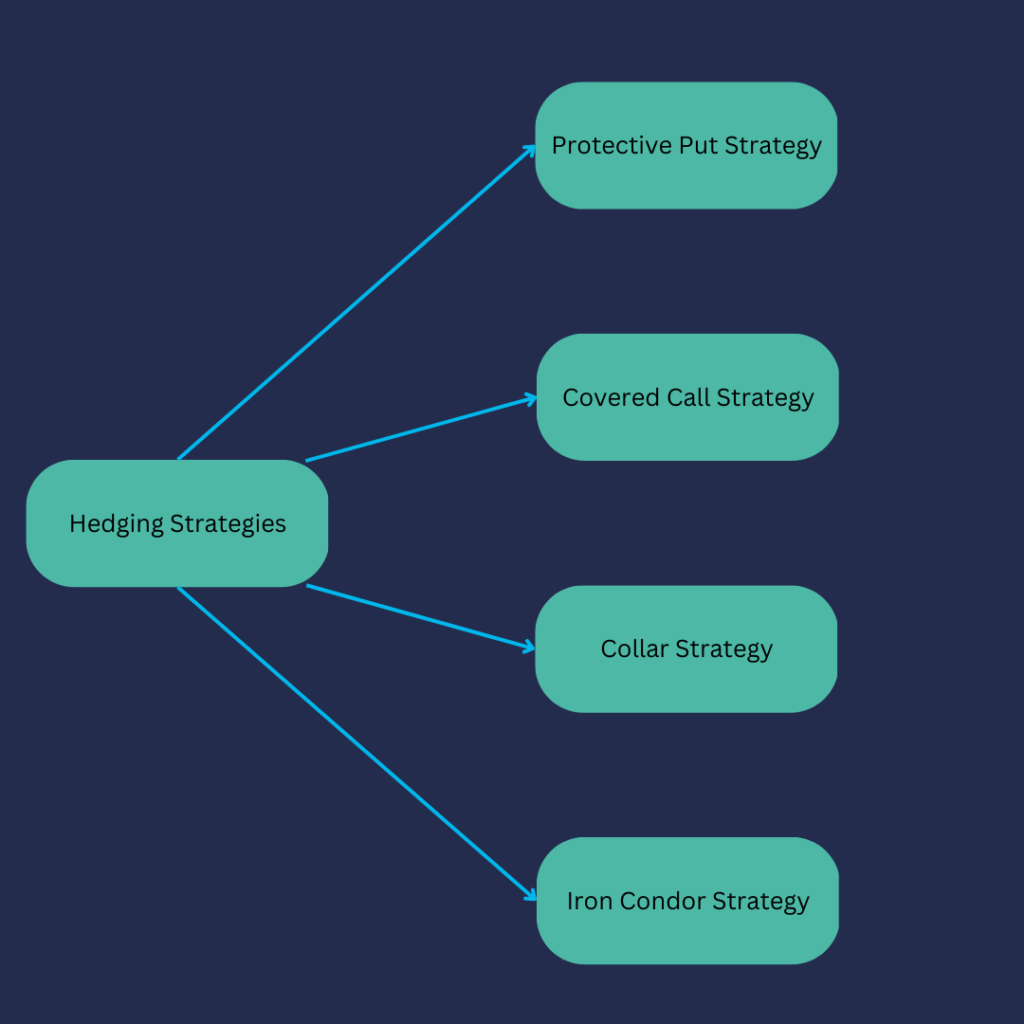

Common Hedging Strategies

- Equity Hedge

Investors holding large equity positions may use index futures or options to protect against market downturns. For instance, a fund heavily invested in the S&P 500 might buy put options or short index futures to offset potential declines. - Commodity Hedge

Producers or users of commodities — like oil companies or airlines — hedge using futures contracts. For example, an airline may lock in jet fuel prices months ahead, shielding profits from energy price volatility. - Currency Hedge

Global portfolios face FX exposure when assets are denominated in different currencies. Using forwards or swaps, investors can fix exchange rates, ensuring that gains aren’t erased by unfavorable currency moves. - Cross-Asset Hedge

Sophisticated investors combine instruments — for example, using gold or U.S. Treasuries to hedge against equity market declines. This approach diversifies defense mechanisms, reducing dependency on a single asset class.

The Balance Between Hedging and Over-Hedging

While hedging protects capital, excessive hedging can cap returns. Professional portfolio managers constantly evaluate hedge ratios, ensuring protection doesn’t become a drag on performance.

For instance, a 50% hedge on an equity portfolio may protect half the downside while still allowing participation in market gains. The goal is balance — maintaining exposure to opportunity while mitigating risk exposure to loss.

The Role of Technology in Modern Hedging

Modern Global trading platforms have revolutionized hedging by offering advanced tools for real-time execution and risk tracking. Traders can now:

- Set automated hedge triggers based on market thresholds.

- Access liquidity across multiple exchanges simultaneously.

- Visualize exposure and margin requirements through live dashboards.

This integration of analytics and automation has made hedging more precise, timely, and cost-efficient — a necessity for professional money management in 2025.

Bancara’s Edge in Hedging

Bancara’s infrastructure is designed to meet the demands of professional risk managers and active traders. Its ecosystem provides:

- Access to 80+ FX pairs for precise currency hedging.

- CFDs and Futures on commodities, indices, and major equities.

- Integrated Portfolio Analytics to measure hedge effectiveness in real time.

- Advanced Risk Management Tools that monitor exposure across all assets under one account.

Whether it’s an institution stabilizing global operations or a private investor protecting long-term wealth, Bancara provides a single, seamless platform for executing complex hedging strategies.

Case Study: Institutional Portfolio Defense

Consider a global pension fund exposed to U.S., European, and Asian equities. Rising interest rates and geopolitical uncertainty create potential downside risk.

By using Bancara’s platform, the fund implements:

- FX forwards to lock in exchange rates on overseas holdings.

- Commodity hedges to guard against inflation shocks.

- Index options to cap equity downside without liquidating core holdings.

When volatility spikes, the portfolio remains stable — losses in equities are offset by gains in hedges. This is the hallmark of professional portfolio management: defense that enables growth.

The Psychological Benefit of Hedging

Beyond numbers, hedging provides emotional stability. Traders who know their downside is protected can make decisions rationally instead of reactively. This mindset shift — from fear to confidence — improves consistency and long-term performance.

Professional investors understand that peace of mind is a form of alpha.

Conclusion: Turning Risk into Strategy

Hedging transforms uncertainty into manageable risk. It’s not about avoiding volatility but mastering it. By using structured protection, professional investors maintain stability through crises and agility through recoveries.

Bancara’s Global trading platform empowers traders to design, execute, and monitor hedging strategies across currencies, commodities, indices, and equities — ensuring protection and performance work together, not against each other.

Bancara – Southern Africa Regional Office, Bancara – Southeast Asia Office — explore the Bancara location.